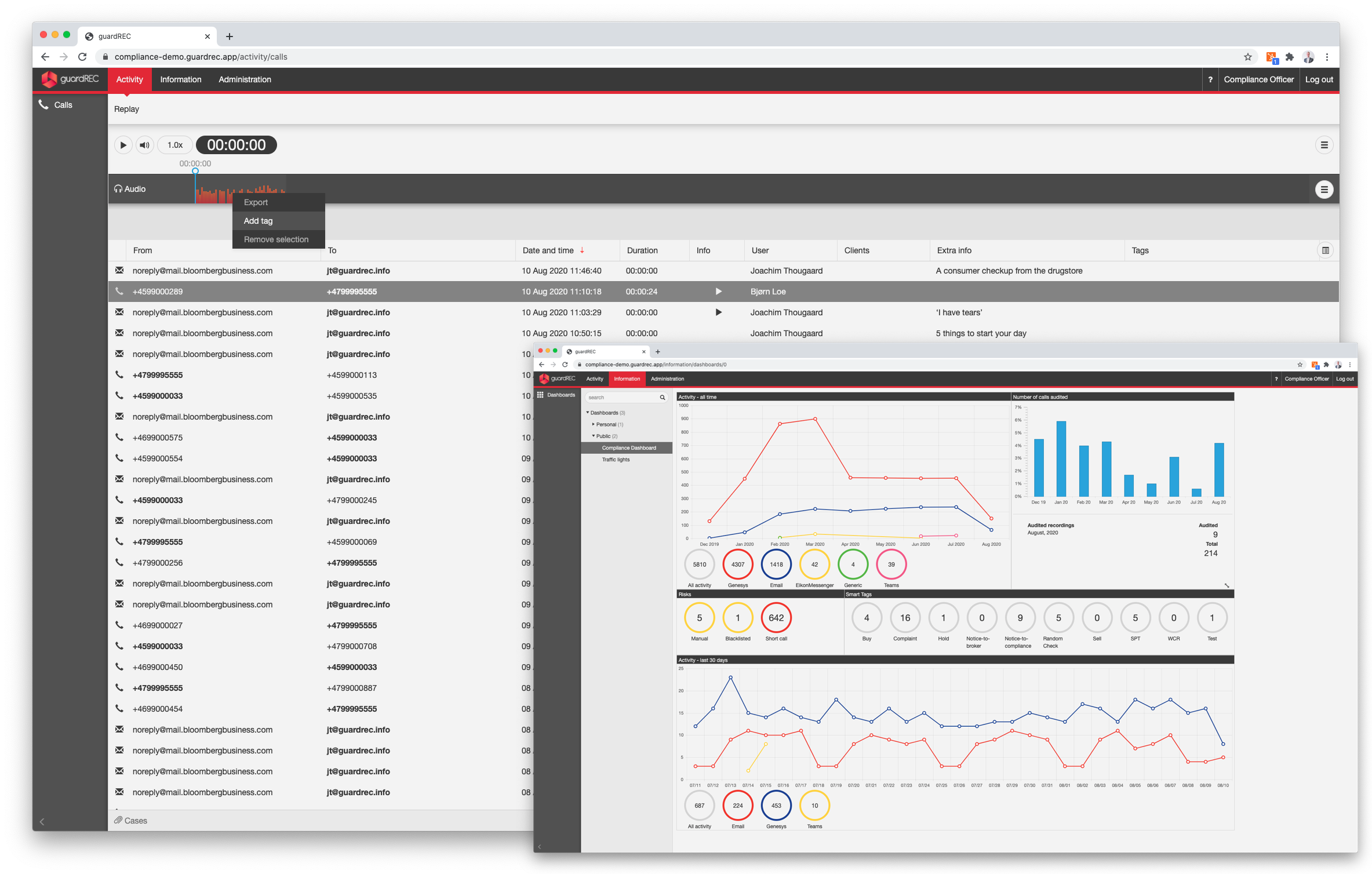

With our multi-channel solution, you can eliminate all your silos. Multi-channel capabilities mean you capture every part of the conversation, from all relevant platforms – calls, chat, emails and more.

Integrated tools to easily create case files with tagged records, enable subject-access rights for GDPR, Suspicious Transaction and Order Reports (STOR) and more. Generate risk management workflows and create audit trails, with complete access history and logging.

Smart search rapidly parses all text-based recordings and delivers results. Integrated transcription (speech to text) converts audio to easily searchable records. Synchronisation means that audio record can be immediately accessed when anomalies or keywords are located.

Enhance AI and ML training with data from trading platforms, market monitors, insider lists, the CRM, and more. Build the bigger picture and discover patterns of interest for evaluation – the digital compliance assistant constantly learns to support your compliance team.